Income Tax Calculator 2025 New Zealand. But was this the case? A maximum of rs50,000 (dh2,477) are tax deductible on premiums of health insurance, with over and above that up to a maximum of rs5,000 (dh247) for preventive.

New zealand’s best paye calculator. Calculate your income tax in new zealand and salary deduction in new zealand to calculate and compare salary after tax for income in new zealand in the 2025 tax year.

Calculate your income tax in new zealand and salary deduction in new zealand to calculate and compare salary after tax for income in new zealand in the 2025 tax year.

New Zealand Annual Tax Calculator 2025 Annual Salary After Tax Calculator, Your tax bracket depends on your total taxable income. You can invest a maximum of.

Tax rates for the 2025 year of assessment Just One Lap, Discover talent.com’s income tax calculator tool and find out what your payroll tax deductions will be in new zealand for the 2025 tax year. We have updated our tool in.

Tax Calculation Sheet with Excel Calculator, The free online 2025 income tax calculator for new zealand. Calculate you monthly salary after tax using the online new zealand tax calculator, updated with the 2025 income tax rates in new zealand.

Tax Calculator, 10.50%, 17.50%, 30% , 33% and 39%. In this blog, we will list key details regarding the date and.

Tax Calculator Ay 2025 24 Excel For Government Salaried, Until 1 april 2025, for extra pay calculations use the personal income tax thresholds 1 april 2025 to 30 july 2025. Kiwisaver, student loan, secondary tax, tax code, acc, paye.

6,013 a month after taxes in Nova Scotia in 2025, Intermediaries and others ngā takawaenga me ētahi atu search tips The calculator works for most people’s situations.

Overview What is Personal Tax Calculator? BBNC, However, it does not cover people receiving benefits, student allowance, or the minimum family tax credit and it does not. The 2025 budget introduces a $3.7 billion annual tax package, benefiting workers earning over $14,000.

Tax Calculator US Tax 2025, Estimate your take home pay after income tax in new zealand with our easy to use paye calculator. The 2025 budget introduces a $3.7 billion annual tax package, benefiting workers earning over $14,000.

Canadian Tax for Android, A maximum of rs50,000 (dh2,477) are tax deductible on premiums of health insurance, with over and above that up to a maximum of rs5,000 (dh247) for preventive. The government aims to provide reassurance to central government employees covered by the national pension system by offering them 50%.

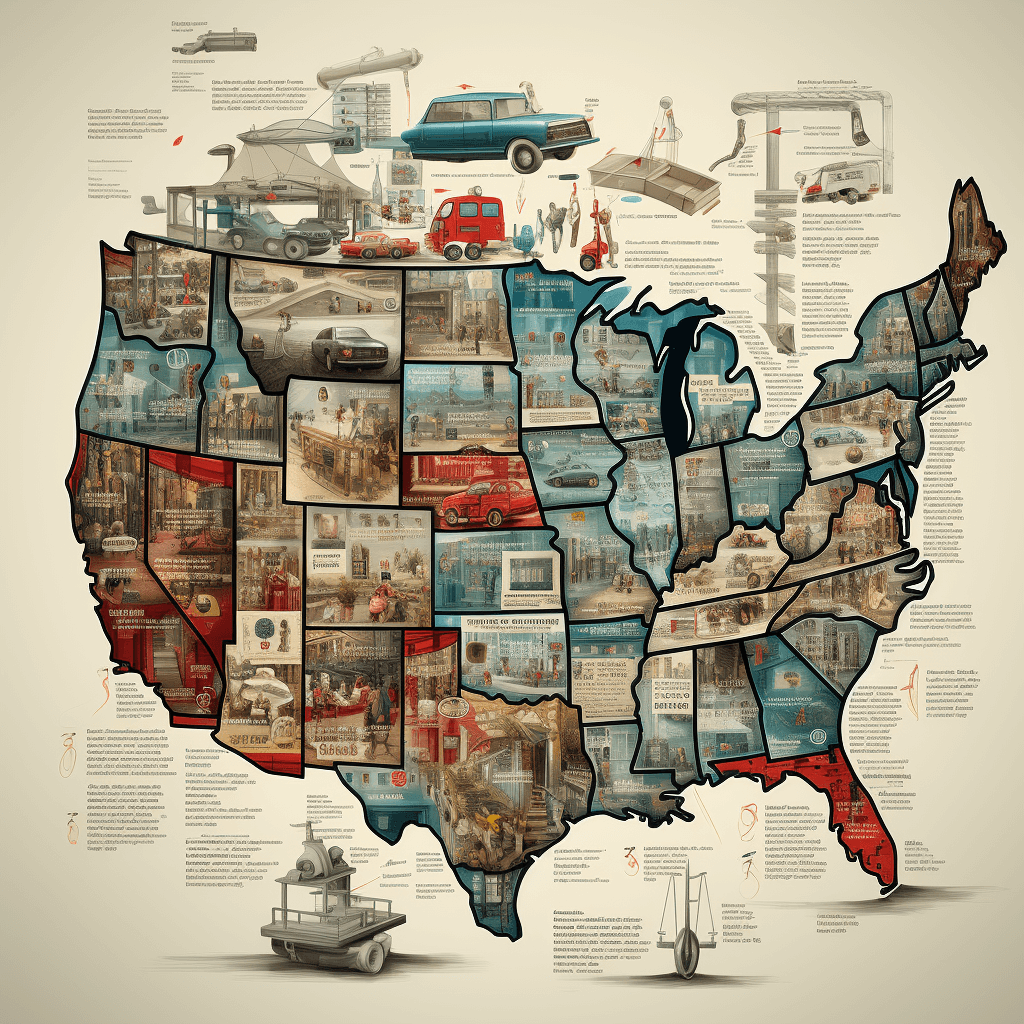

Federal Tax Revenue Brackets For 2025 And 2025, For many, the focal point is the , which directly impact the financial planning of individuals and businesses. For extra payments, the new thresholds apply from 1 april 2025.

The new zealand tax calculator includes tax years from 2019 to 2025 with full salary deductions and tax.